Capital Plan update

In accordance with its Capital Plan, FHLB Cincinnati is raising the minimum amounts of capital stock required for member participation in Advance programs and the Mortgage Purchase Program, as well as the maximum amount for Advances. These changes are effective at the close of business June 19, 2020. The revised Activity Stock Allocations apply to new Advance and MPP activity - for Advance activity that settles after June 19, or MPP activity committed after June 19. Activity that has settled or committed on or prior to this date will continue to carry the current capital requirements and no change in stock purchase allocation percentages will be required to support that prior business.

This change is being implemented after careful review by FHLB management and your Board. This action is being taken to reduce members' reliance on the Bank's Excess Stock pool, and to maintain member access to their own Excess Stock. The FHLB believes these changes will ensure we continue to operate in a safe and sound manner, continue to meet our members' needs and expectations, and comply with FHLB regulatory expectations on overall Bank capitalization.

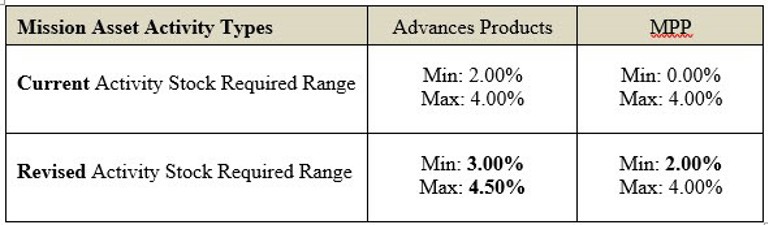

The current and revised ranges are as follows:

Current requirements may be found in the Capital Plan, at Article VI, Section 4.a.iii. In accordance with the Capital Plan, the Bank is providing 30 days advanced notice to members before these changes become effective. As a result, this change will be effective at the close of business Friday, June 19, 2020.

Once effective, the new Capital Plan changes will be available here. If you have any questions regarding this update, please do not hesitate to contact your Relationship Manager toll-free at 877-925-3452, or James C. Frondorf, First Vice President of Credit Services, at 800-828-4191.